A world-class tax compliance product

designed specifically for Dominican Republic’s local requirements.

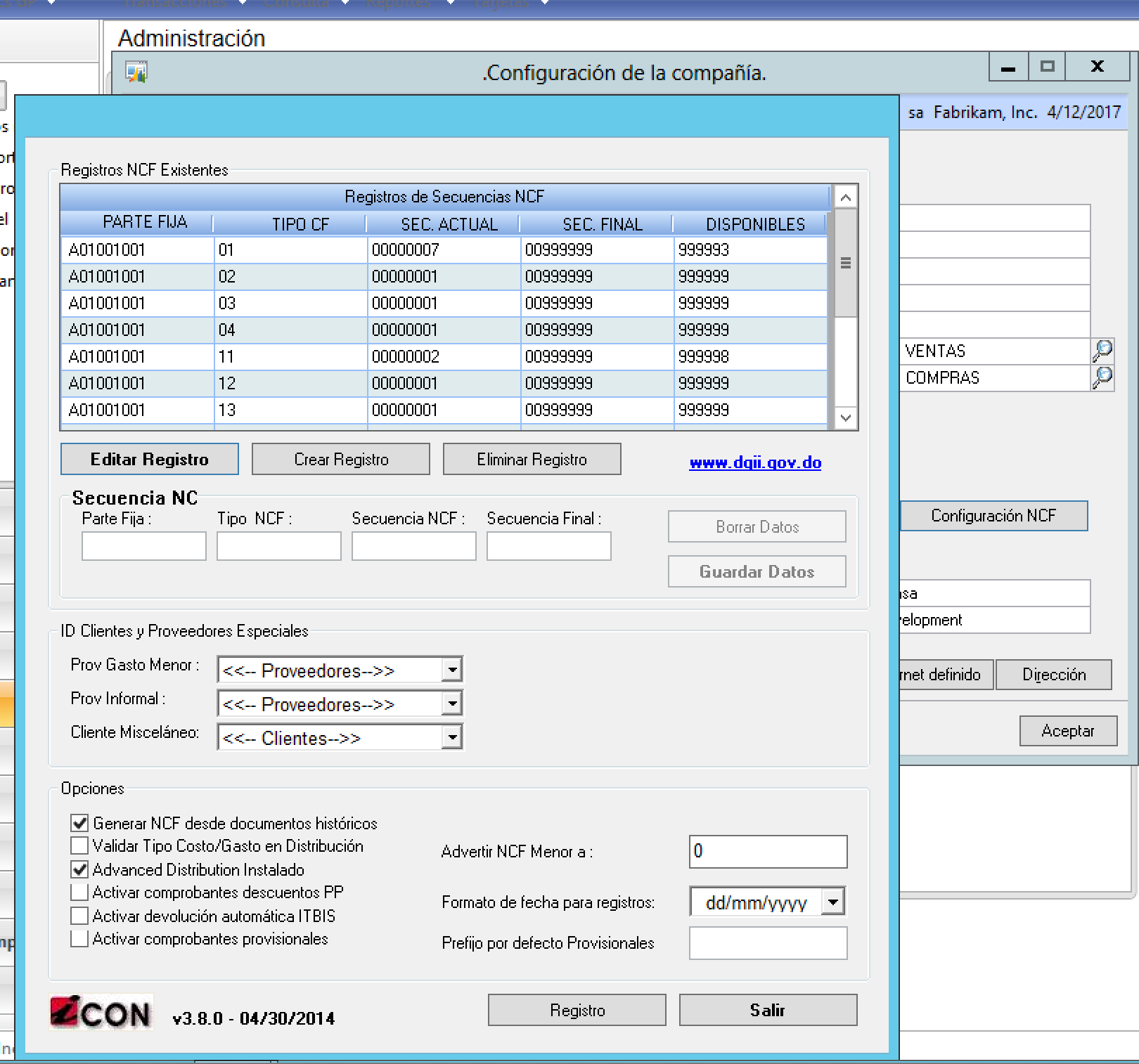

iNCF system is ICON’s response to the tax compliance laws and regulations established by the Dirección General de Impuestos Internos (DGII)—the Dominican tax authority—in January 1st, 2007. According to these requirements, all companies registering sales and purchase operations in the country must use fiscal numbering sequences issued by the DGII for reporting their operations for tax purposes.

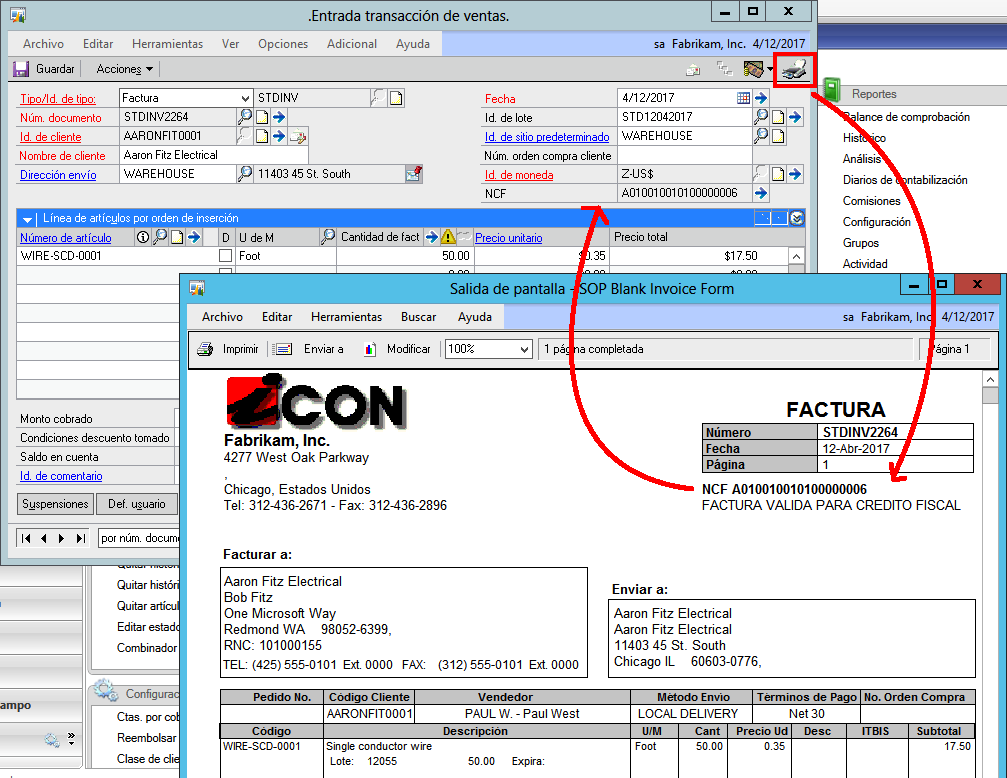

All NCF functions, totally integrated to Microsoft Dynamics GP

ICON’s iNCF allows your users to control all aspects of the management of the fiscal numbers under DGII rules in a way that is completely integrated to Dynamics GP and transparent to the users. The specific way in which numbers are generated, captured and validated varies depending on the area of the system (sales, purchases, bank transactions), as well as the type of NCF number associated to the entity in question (customer, vendor or bank). The iNCF system is designed to generate NCF numbers at the time documents are printed, and a big part of the functionality of the product is designed to guarantee the quality and integrity of the data. iNCF alerts the user when some required information is missing, and stops them from doing things that would risk the integrity of the tax data.

iNCF is homologated by the DGII as complying with its rules and regulations, as well as to be used with the tax authority’s fiscal printers, required for retail stores from January 1, 2014. If your company uses Dynamics GP, you need the most powerful NCF management system: iNCF.

iNCF will generate the correct fiscal number according to current laws, with no particular intervention from the user, depending on the classification of the customer or vendor, and the type of transaction being made. Likewise, iNCF allows you to audit and report to the DGII very quickly and easily, eliminating all of the manual work associated with month end closing and reporting to the tax authority.

Contact us for a demonstration today!